Have Questions About Property Damage Claims?

We Have The Answers

• DWELLING

• OTHER STRUCTURES

• CONTENTS

• HOTEL OR RENTAL COST

• LOSS OF RENT OR INCOME

• WATER OR MOLD REMEDIATION

• BUSINESS INTERRUPTION

• LAW & ORDINANCE

• INCREASED FOOD COST

• DEBRIS REMOVAL

• HOA ASSESSMENTS

• BUILDING PROPERTY

• BUILDING PERSONAL PROPERTY

• AND MUCH MORE...

At Code One, we know just how confusing an insurance policy can be to understand, and we take pride in making these complex documents easy to understand for our clients.

As Miami’s Property Insurance Claims Experts, our job is to make sure you are made whole and fully compensated for your insurance claim damages, because unlike the insurance adjuster who’s sent to your home by the insurance company… we work for you.

Our property claims experts work tirelessly to ensure that your claim is resolved quickly and for its actual value, not just what someone thinks it should be worth. We’re experienced handling the following types of claims:

- DWELLING

- OTHER STRUCTURES

- CONTENTS

- HOTEL OR RENTAL COST

- LOSS OF RENT OR INCOME

- WATER OR MOLD REMEDIATION

- BUSINESS INTERRUPTION

- LAW & ORDINANCE

- INCREASED FOOD COST

- DEBRIS REMOVAL

- HOA ASSESSMENTS

- BUILDING PROPERTY

- BUILDING PERSONAL PROPERTY

- AND MUCH MORE...

REQUEST YOUR FREE CLAIM & INSURANCE POLICY EVALUATION

Contact Us

We will get back to you as soon as possible.

Please try again later.

Contact Us

We will get back to you as soon as possible.

Please try again later.

When you need to file an insurance claim because of damage to your home or business in Miami Dade, Broward, Monroe, Palm Beach or any other county in throughout the State of Florida trust the experts at Code One Public Adjusters to respond quickly so you can get your life back to normal with as little stress as possible.

From Kendall to Key West, Miami Beach to Miami Gardens, Pinecrest to Plantation, West Miami to West Palm Beach, don’t face your insurance carrier alone.

Call Code One Public Adjusters at

(786) 877-3407 Se Habla Espanol

Answers to Your Most Frequently Asked

Property Insurance Claim Questions

How much more will I receive by hiring a public adjuster?

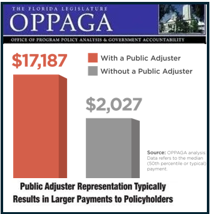

According to the OPPAGA government study done in 2010, homeowners received 574% higher payments for regular insurance claims & 747% more for catastrophe insurance claims when using a public adjuster. The exact amount is not the same for every insurance claim.

How do public adjusters charge for their services?

At Code One Public Adjusters, we work on a contingency fee basis—meaning we only get paid if you do. Our fee is a percentage of the insurance company’s final settlement with you.

There are:

· No upfront cost

· No hidden fees

· No payment owed unless we secure results

Because our success is directly tied to yours, you can trust that it’s always in our best interest to fight for the maximum compensation on your behalf.

How do public adjusters get paid?

We get paid a percentage of the recovery amount for your insurance claim. It is a contingency contract, and we don't get paid unless you do. There is NO RECOVERY, NO FEE.

How long does the free inspection take your public adjuster?

This varies based on the size and type of loss. A typical small water damage claim will take about 30-45 minutes. Large water, hurricane, flood, or fire claims can take longer.

How long is the insurance claim process?

The insurance claim process varies for every claim. However, the process is fastest when our public adjusters are involved from the very beginning. Insurance claims we need to take over once they are denied generally take the longest. The best answer is 2-6 months from when we are hired regardless of how long the claim has been going prior to our involvement. Insurance companies are supposed to decide within 90 days of the original reported date per Florida Statutes. Once a decision is made, there is no set time, so the earlier we get involved, the better.

What happens if my home is not livable after a loss?

If your home becomes uninhabitable after a loss, most insurance policies include provisions to help with temporary housing. This may include hotel stays, rental homes, or other living arrangements arranged by your insurance company.

Many policies also provide Additional Living Expense (ALE) coverage, which helps pay for the extra costs of living elsewhere while your home is being repaired or rebuilt. The length of ALE coverage depends on your specific policy:

Some policies cover up to 12 months after the loss.

Others may extend coverage to 24 months.

Coverage is determined on a case-by-case basis and outlined in your policy contract.

Tip: If your home is not safe to live in, notify your insurance company immediately and ask about your ALE coverage options. Code One Public Adjusters can review your policy and ensure you get the housing support you’re entitled to.

Will my insurance company raise my rates for having an insurance claim?

While there is no definitive yes or no to this answer, as each carrier, insurance claim, and situation is different, the best answer is that this is possible. The insurance company can raise your rate for non-catastrophe claims, but often the increase in rate will take years to recoup the claim payment. If a claim is $10,000 and your insurance increases $500, it will take 20 years for the insurance company to recover the money, and insurance claims typically stay on your record for 3 years.

What if your public adjuster cannot receive an insurance claim payment?

If for some reason your insurance company denies your claim and we are unable to overturn the denial, an attorney may be needed. Often claims are not paid properly due to bad faith, improper denials, or other policy violations that an attorney may be able to help us overcome. There are certain statutes, rules, and regulations that insurance companies must follow during every claim. Our public adjusters make sure to line up all paperwork within these and any policy guidelines. Once these issues are overcome by an attorney, your public adjuster can either assist in negotiations or return to any mediation or appraisal processes at our disposal. If you are not a client but require the service of an attorney, please contact us, and we will be happy to provide you with a few names of someone that can assist you.

How Can a Public Adjuster Help You?

Our public adjusters are experienced policy experts that help streamline your claims process in order to reduce stress for our clients, because we handle everything for you to deliver proven results that increase settlements far above what the insurance company may initially offer.

What Is an Appraisal?

Appraisal is the method preferred by most public adjusters. If our respective financial positions are too far apart, then we may notify the insurance company that we wish to move the issues into the appraisal process. In the appraisal process, both sides agree on a neutral umpire who will make a financial determination of our claim, and that umpire’s decision is final. Before meeting with the umpire, the insurance company will appoint an appraiser/expert to represent them. We act as your appraiser/expert. Usually both appraisers/experts meet at a loss to review both estimates to look for compromise. If there is too much difference to compromise, then the estimates and support documentation are sent directly to the umpire. The umpire will make a final decision in a week to ten days. Remember that the umpire’s decision is final.

What is mediation in an insurance claim?

Mediation is a process outlined in the State of Florida Insurance Statutes. It takes place after you’ve received some compensation from your insurance company but before filing a lawsuit for additional compensation. A mediator (appointed by the state within 30 days of your request) meets with you, your public adjuster, your insurance company’s representative, and any other named parties in the policy.

The mediator’s role is to help both sides reach a fair settlement and avoid a lawsuit. Mediation sessions are usually short—often less than an hour—and are not binding unless all parties agree to the outcome.

How effective is mediation?

Mediation is often successful, and the chance of not settling is less than 1 in 100 cases. If mediation works, the matter is resolved quickly. If it does not, you still have the option of filing a lawsuit. Insurance companies typically want to avoid trials because they can face additional penalties for bad faith.

What happens if mediation doesn’t settle my case?

If mediation ends in an impasse, you may proceed with a lawsuit. While suing an insurance company is not immediately costly for the insured, it can take time and be stressful. The good news is that Code One Public Adjusters works with experienced attorneys who specialize in representing policyholders against insurance companies.

Why should I choose mediation?

Mediation gives you the chance to resolve your claim faster, without the stress and delays of going to court. It is designed to save time, reduce expenses, and help you receive the compensation you deserve sooner.

Claim Types Our Public Adjusters Handle

Fast, reliable help for water damage claims. Code One Public Adjusters protects homeowners & businesses in South Florida.

Fire damage can devastate your property. Code One Public Adjusters fights for South Florida homeowners & business owners.

Roof damage impacts every property owner eventually. Code One Public Adjusters makes sure your insurance claim is handled right.

When flooding strikes, Code One Public Adjusters protects South Florida property owners with expert flood damage claim support.

Mold claims are complex with policy exclusions. Code One Public Adjusters helps South Florida property owners get fair settlements.

One hurricane can cause massive damage & risk your safety. Code One Public Adjusters helps South Florida families recover fair settlements.

Vandalism

Code One Public Adjusters works closely with property owners to manage vandalism claims and secure fair compensation.

Loss of Income

Code One Public Adjusters analyzes damages & represents your business to recover fair payouts for income loss claims.

DID YOU KNOW USING A PUBLIC ADJUSTER CAN INCREASE YOUR SETTLEMENT BY AS MUCH AS 747%

Public adjusters in Florida have proven effective in helping with an insurance claim settlement.

Questioning if Florida Public Adjusters could help with your insurance claim?

The Office of Program Policy Analysis & Government Accountability (OPPAGA), an office of the Florida Legislature, performed a study on Florida public adjusters.In this study they evaluated claims filed with Citizens from March 2008 to June 2009, for a total of 76,321 claims.Of these claims, 21,545 were represented by Florida Public Adjusters, while the comparison group consisted of the 54,776 claims that either had no representation or were represented by a party other than a public adjuster.

What they found was that during the 2005 hurricane season, policyholders without the assistance of a public adjuster received payments averaging $2,029, while those policyholders that utilized the services of licensed Florida public adjusters received payments of $17,187. That is a 747% increase in average claim payout with the assistance of a public adjuster or private adjuster.

It further studied results for non-catastrophic claims; those that did not use the services of a public adjuster received an average payout of $1,391, while those that utilized a licensed public adjuster received a settlement of $9,379, an increase of 574% for those policyholders that utilized a public adjuster to assist in the handling of the claim.

Let’s Talk About Your Claim

Request Your Consultation for a Free Leak Detection, Property Inspection & Policy Evaluation

We will get back to you as soon as possible.

Please try again later.

Trust an Experienced Public Adjuster

At Code One, we understand that filing an insurance claim can be a daunting and time-consuming task. That’s why we’re here to help.

We’re experienced in dealing with all of Florida’s insurance companies and will work tirelessly to get you the settlement you deserve.

Our attention to detail from preparing your claim to negotiating with the insurance company has earned us a proven track record of success and a reputation for getting you the settlement you deserve.

If you’ve suffered property damage, don’t wait to call us now at (786) 877-3407.

We offer free consultations, so you can learn more about how we can help you get the compensation you deserve.