When storms, hurricanes, or wear-and-tear cause roof damage in Miami, FL, the results can be costly and dangerous. Roof leaks, missing shingles, or structural issues not only affect your home’s protection but also lead to water intrusion, mold, and interior damage. Unfortunately, many insurance companies try to minimize or deny roof damage claims.

At

Code One Public Adjusters, we specialize in roof damage insurance claims for homeowners and businesses. Whether your claim is

new, denied, delayed, or underpaid, our team advocates exclusively for policyholders to secure the maximum settlement you deserve.

REQUEST YOUR FREE CLAIM & INSURANCE POLICY EVALUATION

Contact Us

We will get back to you as soon as possible.

Please try again later.

Contact Us

We will get back to you as soon as possible.

Please try again later.

Why Choose Code One for Roof Damage Claims?

Decades of experience

helping Florida homeowners and businesses recover maximum settlements.

Expertise with new, denied, and underpaid claims

across the State.

No Recovery, No Fee

You pay nothing unless we recover money for you.

Fully licensed & insured

public adjusters committed to protecting policyholders.

Same-day appointments and 24-hour emergency service when urgent roof issues arise.

Don’t let your insurance company undervalue your roof damage claim. With Code One on your side, you have professionals who fight to ensure your losses are fully covered.

Simplified Roof Damage Insurance Claims Process

Free Consultation

Contact us today to discuss your roof damage and schedule a free claim evaluation.

Comprehensive Evaluation

We perform a thorough roof inspection, document damages, and review your insurance policy for potential coverage.

Expert Representation

Our licensed adjusters negotiate directly with your insurer, making sure every detail—from missing shingles to full roof replacement—is included.

Successful Recovery

We pursue maximum compensation for your roof claim. No upfront costs, and no fees unless we recover money for you.

Types Of Roof Damage We Handle

Roof damage comes in many forms, and insurers often overlook or downplay the extent of losses. At Code One, we ensure your roof damage is fully documented and fairly compensated.

Storm-Related Roof Damage

High winds and hail can rip shingles and compromise roofing systems. We push for full repair or replacement coverage.

Roof Leaks and Water Intrusion

Leaks lead to interior and structural damage. We make sure your settlement includes remediation for all resulting losses.

Hurricane Roof Damage

Hurricanes frequently cause catastrophic roof damage in Florida. We handle these claims aggressively to maximize payouts.

Structural Damage to Roof Systems

Collapsed or weakened structures must be rebuilt, not patched. We advocate for comprehensive coverage.

Commercial Roof Damage

Flat roofs, industrial buildings, and commercial properties face unique risks. We pursue claims that address both structural and financial losses.

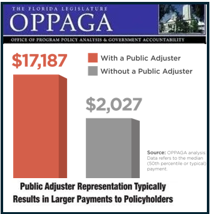

DID YOU KNOW USING A PUBLIC ADJUSTER CAN INCREASE YOUR SETTLEMENT BY AS MUCH AS 747%

Public adjusters in Florida have proven effective in helping with an insurance claim settlement.

Questioning if Florida Public Adjusters could help with your insurance claim?

The Office of Program Policy Analysis & Government Accountability (OPPAGA), an office of the Florida Legislature, performed a study on Florida public adjusters.In this study they evaluated claims filed with Citizens from March 2008 to June 2009, for a total of 76,321 claims.Of these claims, 21,545 were represented by Florida Public Adjusters, while the comparison group consisted of the 54,776 claims that either had no representation or were represented by a party other than a public adjuster.

What they found was that during the 2005 hurricane season, policyholders without the assistance of a public adjuster received payments averaging $2,029, while those policyholders that utilized the services of licensed Florida public adjusters received payments of $17,187. That is a 747% increase in average claim payout with the assistance of a public adjuster or private adjuster.

It further studied results for non-catastrophic claims; those that did not use the services of a public adjuster received an average payout of $1,391, while those that utilized a licensed public adjuster received a settlement of $9,379, an increase of 574% for those policyholders that utilized a public adjuster to assist in the handling of the claim.

Let’s Talk About Your Claim

Request Your Consultation for a Free Leak Detection, Property Inspection & Policy Evaluation

We will get back to you as soon as possible.

Please try again later.

Trust an Experienced Public Adjuster

At Code One, we understand that filing an insurance claim can be a daunting and time-consuming task. That’s why we’re here to help.

We’re experienced in dealing with all of Florida’s insurance companies and will work tirelessly to get you the settlement you deserve.

Our attention to detail from preparing your claim to negotiating with the insurance company has earned us a proven track record of success and a reputation for getting you the settlement you deserve.

If you’ve suffered property damage, don’t wait to call us now at (786) 877-3407.

We offer free consultations, so you can learn more about how we can help you get the compensation you deserve.

Proudly Serving All Of Florida

From

Miami to Tampa, Jacksonville to West Palm Beach, Key West to Port Jupiter, and everywhere in between, Code One Public Adjusters proudly serves property owners statewide. With 24-hour availability and personalized attention, we’re here to help you recover from roof damage—no matter where you are in Florida.

We’re Here To Help. Expert Insurance Claims Help With:

• Air Conditioning Leaks

• Business Interruption

• Chipped Floor Tile

• Debris Removal

• Dishwasher Leaks

• Dwelling/Contents Claims

• Fire Damage

• Flood Damage

• Hotel / Rental Expenses

• Law & Ordinance

• Lightning

• Mold

• Other Structures

• Plumbing Leaks

• Roof Leaks

• Sinkholes

• Smoke Damage

• Storm Damage

• Water Damage

• Wind/Hail Damage

- Air Conditioning Leaks

- Business Interruption

- Chipped Floor Tile

- Debris Removal

- Dishwasher Leaks

- Dwelling/Contents Claims

- Fire Damage

- Flood Damage

- Hotel / Rental Expenses

- Law & Ordinance

- Lightning

- Mold

- Other Structures

- Plumbing Leaks

- Roof Leaks

- Sinkholes

- Smoke Damage

- Storm Damage

- Water Damage

- Wind/Hail Damage

Maximize Your Claim, Minimize Your Stress

SPEAK TO AN INSURANCE CLAIMS EXPERT TODAY.

Call

(786) 877-3407 or email

codeonepa@gmail.com.